Posted by BC-Loans

Loans

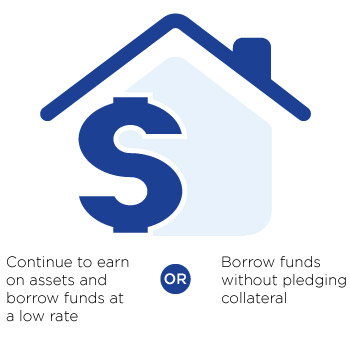

It is a known fact that majority of Canadian are living paycheck to paycheck. They use their monthly cheques to pay for their bills and lifestyle. Such people when have needs to grow or buy something expensive, they turn towards unsecured loans. When it comes to lending options, there are tons of them available for people of Canada. The options range, car loans, mortgage loans to credit card loans as well as payday loans. With so many options for unsecured loans available, which one should you choose?

Traditionally, the unsecured personal market was held by CitiFinancial and Wells Fargo in Canada. In 2010 Wells Fargo left the Canadian market and sold its personal loan portfolio to DBGS Anthem LP.

With the strengthening of CitiFinancial in the Canadian market, payday loan sector also experienced an explosive growth. It is essential to note here that CitiFinancial provides installment loans with longer time frame of repayment and at affordable terms whereas fast or payday loans are usually short term loans at higher rate of interest. Also if short term loans are calculated for an entire year, the interest rate adds up to 400%, which is too much for an Middle- income holder. The increase in online payday loans has resulted in payday loan trap or payday loan cycle.

A person enters a payday loan when he is in need of instant cash and agrees to pay it back on his next check along with the interest rate offered. If he is unable to pay the loan in time then he takes second payday loan to clear the first. The cycle continues until he pays back the original loaned amount along with the penalties and other interest rates charged. Another trouble with such loans is that any missed payment on such loans can hurt your credit card score and if you are not able to consolidate your debts fast then you might not be able to escape this cycle and will have to search other options like consumer proposals, debt reduction programs or bankruptcy.

Some companies have noticed this turn of events and have decided to take essential steps to take part in this sector. Being an A class credit lender, Citifinancial still stays in the game. Also some other lending sources have established themselves as personal loan lender companies are also focusing on pulling out the Canadians from the payday loan trap or avoiding it completely.

Now apart from the major institutions, most of the Canadian cities are home to plenty of small time lenders. These institutes are scattered across the country and their guidelines vary from region to region. But that does not mean that unsecured loans don’t exist. They still are available in variety of options. You can easily choose a recognized institution in your province and fill an application form with them to get your installment loan approved. One can even apply online as it gets easy to submit the forms and documents required as well as it allows the borrower to compare the rates offered by different companies.

Payday advance consumers are the face of the country. People with jobs and families who sometimes have unexpected or unbudgeted expenses between paychecks need short-term loans to meet their debts. These unexpected urgencies can cause crisis in their life if not solved immediately. Thus, most of them choose payday loans to meet urgent cash needs which they think they would be able to pay back with their next paycheck. A person uses a payday loan just like a credit card only, they think they would pay it back in sometime, most of them do but some are not able to and then the real problem emerges.

Now, besides the institutions named above, most Canadian cities are home to various small time lenders. Of course, they are scattered and their lending guidelines differ from region to region but unsecured lending solutions do exist.

Payday or fast loans in Canada is allowed under the section 347.1 of Criminal Code of Canada, as long as the province in which the customer lives confirms to provincial legislation relating to the provisioning of such loans. For places where no such provincial legislation exists (like Newfoundland and Quebec) payday loan charging an interest rate over 60% per annum are considered criminal by usury law.The Supreme Court of British Columbia gave its decision on August 14, 2006, in a class action lawsuit against A OK Payday Loans. A OK took 21% interest rate from its customers, along with a “processing” fee of 9.50 Canadian dollars for every $50.00 borrowed. Also a “deferral” fee of 25 dollars for each $100 was levied if a client delayed his payment. It was ruled out by judge that deferral and processing fees were interest only and A Ok was levying a criminal interest rate. The payout as a consequence of this judgment is likely to be several million dollars. The British Columbia Court of Appeal collectively acknowledged this decision. Here are some stats of people who may or may not go for payday loans or other form of unsecured loans. These stats don’t include people with bad credit score and those not eligible to get an installment loan.

Average-Income

- Most of them earn between $25,000 and $50,000

Average-Educated

- 90% have a high school diploma or more

- 54% have a college degree or similar

Young Families

- 53 % are under 45 years of age (only 9 % are 65 years or older)

- Majority of them are married

- 63 % have children in household